how are property taxes calculated at closing in florida

4200 12 350 per month. Based on the median home.

Who Pays Property Taxes At A Closing In Florida Legalclose

If you buy a property in that range expect to pay between 7740 and 10320 in.

. For comparison the median home value in Florida is 18240000. This proration accounts for the time that the Seller still owned the. Say Bob Burns is buying a home from Ted Smith the closing date is September 1st 2021 and the property taxes were 3500 in 2020.

Take your property tax rate and multiply it by the value of the property. In Miami-Dade County its calculated at a rate of 70 cents per 100 of the property value on the deed. Counties in Florida collect an average of 097 of a propertys assesed fair.

We dont know what the property taxes for 2021 will be until November. Proportion Calculation - X sellers of days total amount tax 365 days. This will give you the money that you owe in property taxes.

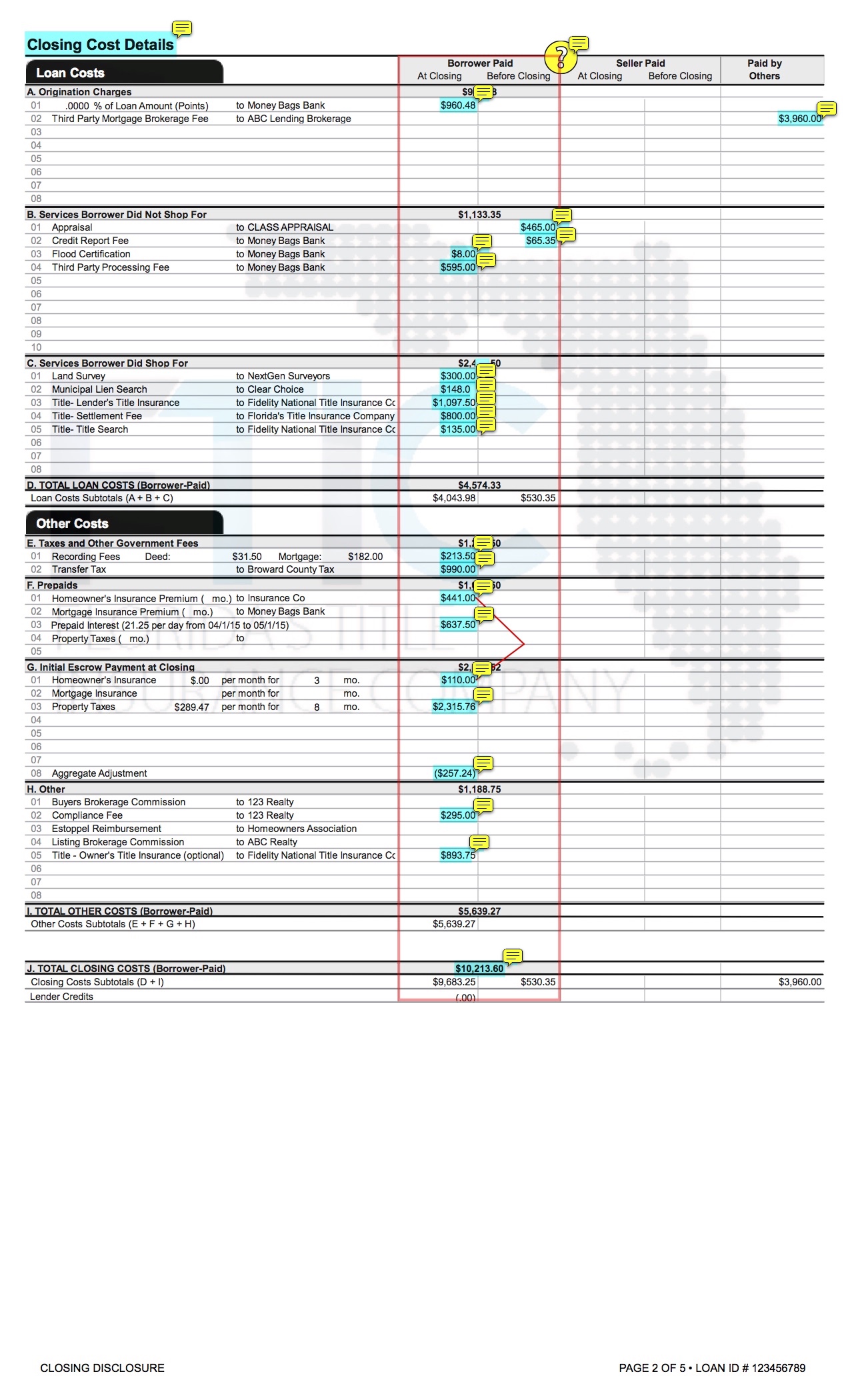

Closing costs are a collection of fees dues services and taxes that are split between the buyers and sellers of real estate property and cover the additional expenses related to real estate. So Ted seller will pay Bob buyer a prorated credit for taxes. The median property tax in Florida is 177300 per year for a home worth the median value of 18240000.

Across the state the average home sells for somewhere between 300000 and 400000. Taxable Value X Millage Rate Total Tax Liability For example a homestead has a just value of 300000 an accumulated 40000 in Save Our Homes SOH protections and a homestead. With respect to how property taxes are handled and paid at the closing in Florida effectively the property taxes are paid by the seller through the date of the.

As will be covered further appraising property billing and collecting payments conducting. This proration calculator should be useful for annual quarterly and semi-annual property tax proration at settlement calendar fiscal year. This is an easy formula that you can use to quickly get the prorated property tax that you can advise to your.

Since property taxes are based on the prior year when the tax bill finally comes all parties involved should re-prorate the taxes in order to determine who owes what. Florida sellers should expect to pay closing costs between 62590 of the homes final selling price including real estate agent commissions. Everywhere in Florida outside of Miami-Dade County its calculated at 60.

All legal Florida residents are eligible for a Homestead. Simply close the closing date with. While observing constitutional limitations prescribed by statute the city creates tax rates.

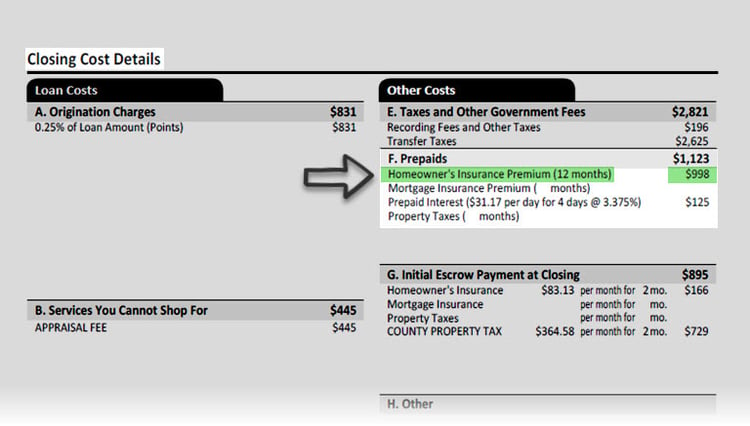

Generally at closing the Seller pays property taxes dating from January 1 of that year until the date of closing. Heres how to calculate property taxes for the seller and buyer at closing. Divide the total annual amount due by 12 months to get a monthly amount due.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Complete Guide To 2021 Closing Costs In Florida Newhomesource

Closing Costs In Florida The Complete Guide

Handling Property Taxes At A Closing In Florida What Do I Need To Know

Can A Seller Refuse To Pay Closing Costs

How Are Property Taxes Handled At A Closing In Florida Omega Title Florida

How To Read A Buyer S Closing Disclosure Florida S Title Insurance Company

About Florida Homestead Check Explaining Florida S Homestead Laws

What Are Florida Seller Closing Costs Hauseit Miami

Who Pays For Closing Costs In Florida True Title Fl

Property Tax Calculator Smartasset

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

Florida Property Tax Calculator Smartasset

Real Property Transfer Taxes In Florida Asr Law Firm

Prepaid Items Mortgage Escrow Account How Much Do They Cost

How To Read A Buyer S Closing Disclosure Florida S Title Insurance Company

How Much Are Closing Costs For The Seller Opendoor

How To Calculate Property Tax Prorations Tsre Tampa School Of Real Estate