reit dividend tax canada

REIT is governed by and established pursuant to a declaration of trust. Trustees of the REIT hold legal title to and manage the trust.

Monthly Dividend Reits 5 Reliable Reits That Pay Every Month Reverse The Crush Dividend Stocks Dividend Income Investing

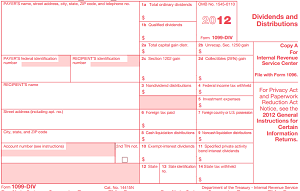

Dividends from real estate investment trusts or REITs are considered taxable income in the eyes of the IRS but theres much more to the story than that.

. In total eight Canadian REITs have either cut or slashed the distribution since the start of the pandemic. REITs voting stock and in the case of REIT dividends paid to a c orp or ati n esid tin C yprus r Eg pt m h5 f REITs gross. Melcor acquires manages and leases commercial property in Western Canada.

You will pay about 282 in income taxes marginal rate but the average tax rate is 2022 and you will pay 10109 in taxes. 28 rows While US. Taxable amount of the other than eligible dividends 200 X 115 230.

When a REIT distributes dividends received from a taxable REIT subsidiary or other corporation 20 maximum tax rate plus the 38 surtax. The fee is reasonable enough and if you invest a substantial amount in this fund you can start a passive income just through dividends. Fundrise just delivered its 21st consecutive positive quarter.

Ad DividendInvestor is an AwardWinning Dividend Screening Platform. When permitted a REIT pays corporate. Again you can view the tax breakdown of CREITs distribution on its websiteIn 2011 CREIT paid 143 in distributions of which 7904 per cent was classified as other taxable.

Total taxable amount 276 230 506. On May 14 HR REIT slashed the monthly distribution in half from. Melcor REIT TSXMRUN is one such company.

Thats 25 for every 10000 invested. Considering you could buy all 6 stocks through a. You will report the total taxable dividends on line 12000.

The REIT collects rental income pays its expenses and then distributes almost all its remaining incomeusually 85 to 95to unit holders. Or you can reinvest those dividends. They do this to avoid paying tax.

How to Get the Benefits Without The Headaches. Ad Potentially Access Up To A 20 Tax Deduction On Qualifying Reit Income. REITs are trusts that passively hold interests in real property.

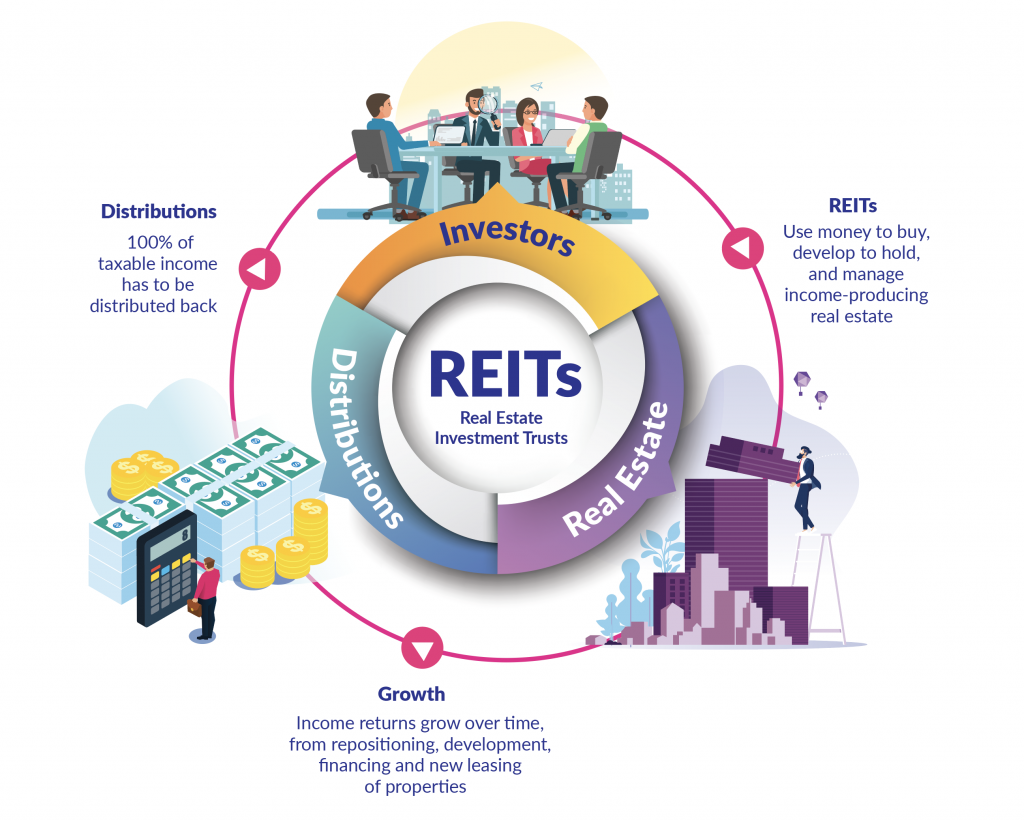

A real estate investment trust REIT is a real estate company that buys and manages properties using money from investors with the REIT then distributing income back. This means that dividend income will be taxed at a lower rate. The Canada Revenue Agency applies a 150198 tax on the tax portion of eligible dividends and a 9031 rate on the tax portion of non-eligible dividends.

These REITs are Under 49. In mid-March this Canadian REIT reduced the. Ad Bold Trades on Real Estate - In Either Direction Bull or Bear.

REITs typically pay quarterly dividends most Canadian REITs pay monthly. If you have 50000 in capital gains in BC you will. Wide Range Of Investment Choices Including Options Futures and Forex.

Ad Bold Trades on Real Estate - In Either Direction Bull or Bear. Dividends are taxed at a lower rate. The reason why is somewhat complicated and is related to a Canadian taxation principle called the dividend tax credit The dividend tax credit meaningfully reduces the.

Ad Investing in Real Estate Can Be Lucrative. Over the long term paying that 025 expense ratio is going to eat into your returns. Wish You Could Invest in the Lucrative Real Estate Market.

Taxpayers who hold Canadian dividend-paying stocks can be eligible for the dividend tax credit in Canada. 5 tax rate if the corporate shareholder owns at least 10 of the.

Reit Taxation A Canadian Guide

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

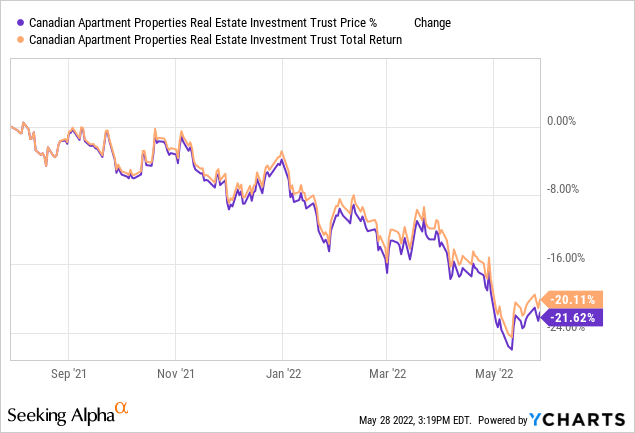

Canadian Apartment Properties Reit Is It A Cheap Dividend Stock Otcmkts Cdpyf Seeking Alpha

Finding The Reit Income Opportunity In 2020 Horizons Etfs

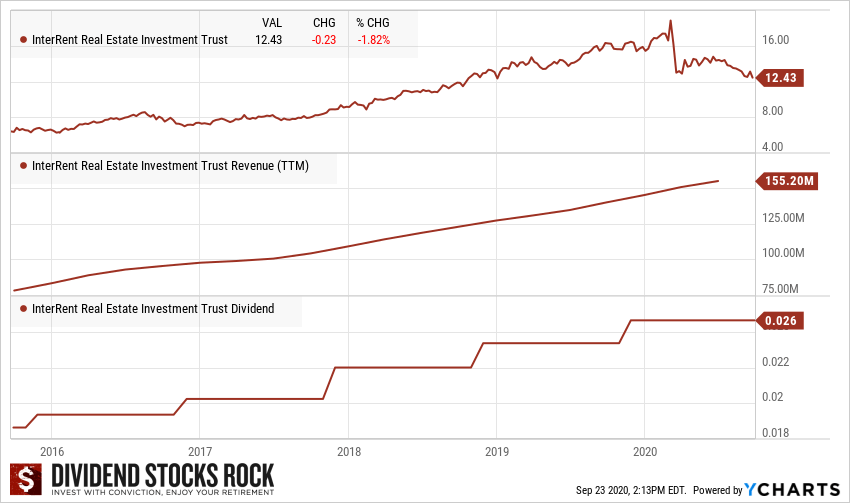

Top 3 Canadian Reits For 2020 And Why Riocan Is Not Part Of It Seeking Alpha

Reit Taxation A Canadian Guide

Dividend Income Report August 2020 Reverse The Crush Dividend Income Dividend Dividend Investing

Reits Vs Bonds In Retirement Intelligent Income By Simply Safe Dividends

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

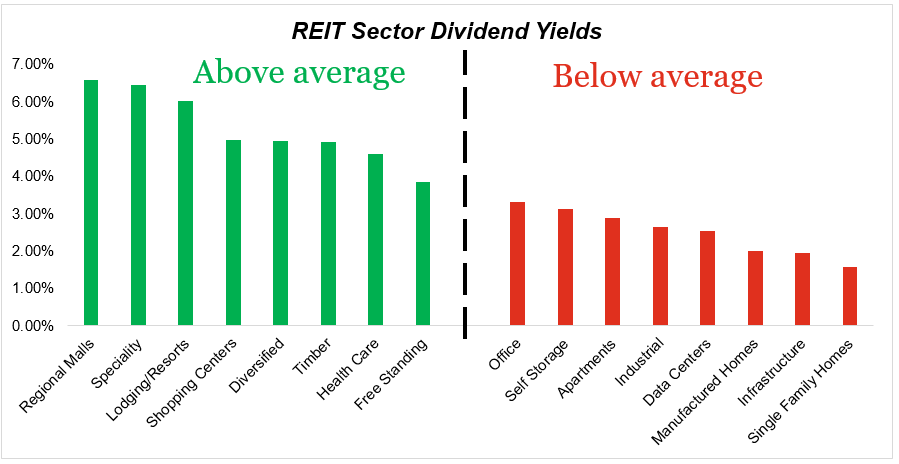

Reit Sectors From The Lens Of A Dividend Investor Seeking Alpha

Understanding The Reit Taxation Rules Novel Investor

Smartcentres Reit Sru Un A Smart Reit For Income Investors Reverse The Crush Personal Finance Lessons Income Investing Investing Money

Reits Vs Real Estate Mutual Funds What S The Difference

The Reit Stuff How Reit Etfs Can Send Your Dividends Through The Roof Nasdaq

Reits Canada Still Offers Tax Advantages For These Investments